The CFO Question

We have $2M in the modernization budget. Why should we spend it on your tech debt instead of new features?"

You scramble to build a spreadsheet. It takes 2 weeks. The data is subjective. No one trusts it.

The Board Meeting

"What's our technical risk profile?"

You want to say "Our billing system is 8 years old and has moderate risk" but you have no objective way to quantify "moderate." You sound defensive instead of data-driven.

The M&A Nightmare

the solution

What If You Could Walk Into That Next Stakeholder Meeting With This Instead?

"Our tech debt index is 48, which puts us in the 'Significant Debt' category. I've identified 50 components across 4 product lines. The Payment Gateway scores 75 on tech debt—our highest risk asset."

"If we don't address it, we're looking at Quality Impact on our core revenue cycle. Fixing it costs $100-500K but prevents an estimated $X in customer churn risk."

"Here's the executive report. Here's the remediation project with timeline and ROI. Here's why we should prioritize this over the Claims Processing System."

That's the difference Tech Debtonator makes.

M&A Due Diligence

Modernization Planning

Board & Executive Reporting

Ongoing Governance

With Tech Debtonator:

With Tech Debtonator:

With Tech Debtonator:

With Tech Debtonator:

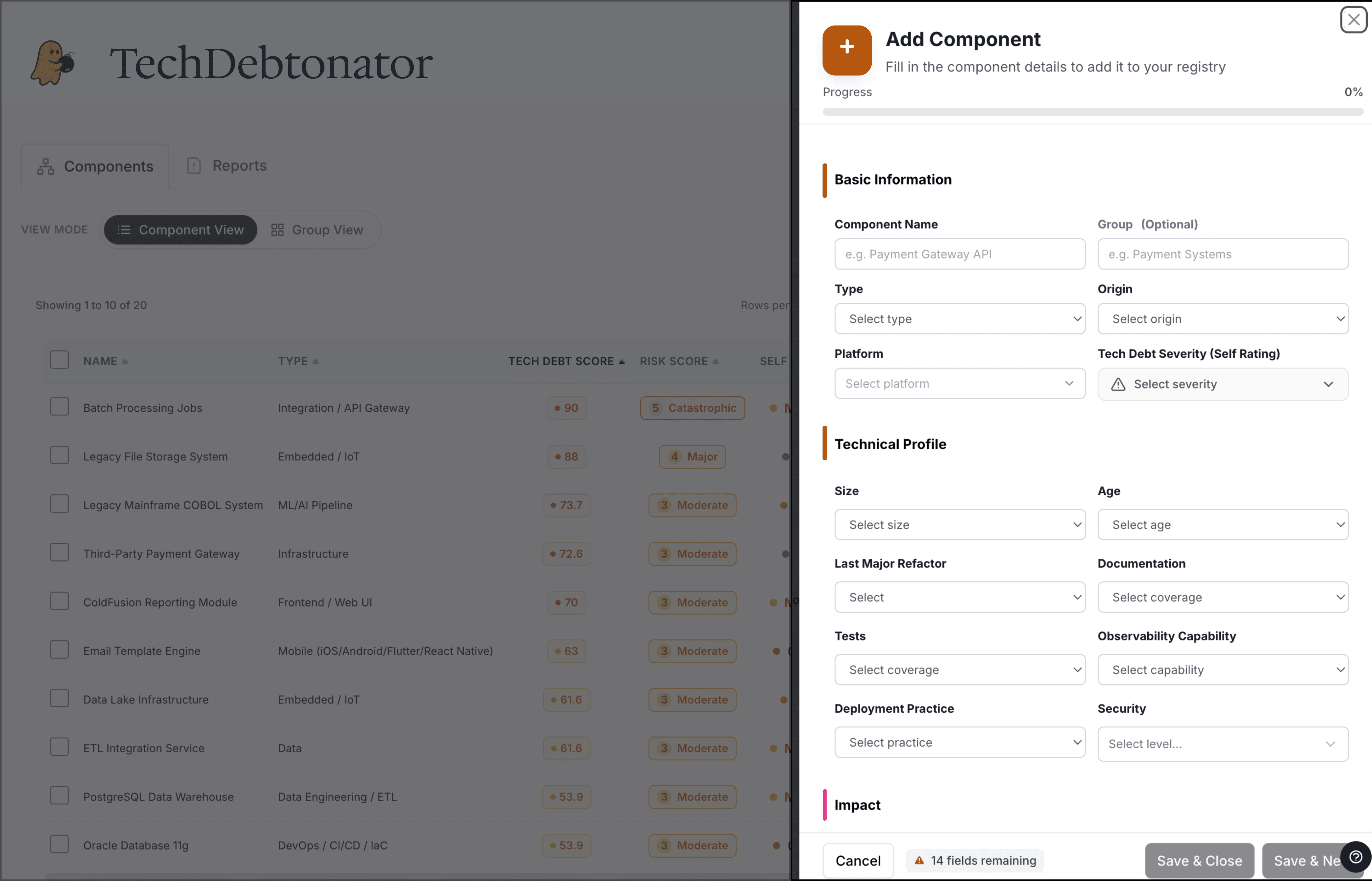

How it works

From Chaos to Clarity in A Day.

21-Day Trial

Inventory and score your tech stack.

Explore AI recommendations and remediation plans.

Generate executive-ready reports for your current snapshot

Unlimited Use

Start Free Trial

Tech Debtonator Unlimited

$55/mo

Unlimited components, workspaces, and scoring runs

Continuous portfolio monitoring and trend analysis

Full access to remediation decision engine and reporting

All feature updates and improvements included

Priority email support from experienced engineering leaders

Subscribe Now

Start free when you sign up for Tech Debtonator now.

©2025 Copyright EBTN, Inc.